Investing can seem complicated with so many options available. However, one of the simplest and most effective strategies is to invest in index funds that track the market.

Whether you’re just starting or expanding your portfolio, these opportunities are worth considering. They provide access to a wide range of stocks with low fees and minimal effort.

This guidebook explains what these funds are, how they work, and why they could be a smart choice for your financial goals.

If you’re new to investing, this post is tailored for you. Discover how this strategy can help grow your money over time.

#1. What are Index Funds?

These are a type of exchange-traded funds or mutual funds designed to monitor the returns of a market index.

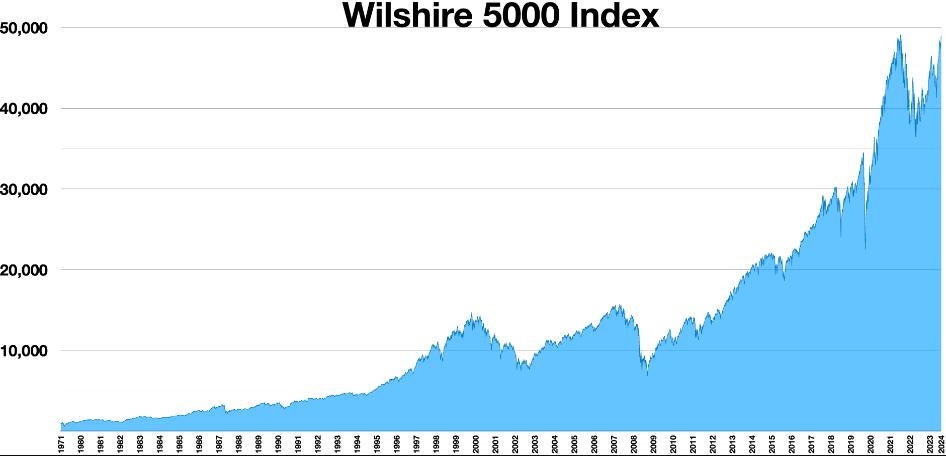

Examples of market indexes that they attempt to track include the Russell 2000 Index, the Wilshire 5000 Total Market Index, and the S&P 500 Index.

Popular among those seeking reliable opportunities, these investments aim to maximize long-term returns by minimizing frequent trading.

They provide a cost-effective way to gain exposure to the performance of a market index, making them an excellent choice for those prioritizing affordability and diversification.

This low-effort, long-term strategy offers passive income by tracking specific market indexes. Investing in such index funds means owning a portion of each company within the index.

By choosing this type of investment, you can diversify your portfolio and lower the risks associated with individual stocks.

It’s an invest-and-forget strategy, perfect for anyone seeking steady, long-term income opportunities.

#2. How Much Can You Make by Investing in Index Funds?

Investing in well-established funds allows individuals to benefit from stock market growth while managing risk through diversification across multiple companies. Average returns depend on the specific index and market conditions.

Over time, major indices like the S&P 500 have historically delivered annual returns of 7% to 10%. These returns may vary with market volatility and economic trends.

Index Funds pool resources from investors and often distribute much of their taxable income as dividends. Real Estate Investment Trusts (REITs) are a great way for newcomers to earn passive income, offering exposure to real estate markets without the challenges of owning or managing properties directly.

It’s worth mentioning in this index funds guidebook that one of the significant benefits of investing in top index funds is the power of compounding.

Reinvesting dividends and allowing the investments to grow over time can lead to high compounding returns. This can significantly increase your overall wealth over time.

#3. Types of Index Funds

There’s no one-size-fits-all approach to investing. Curious about the various types of opportunities available?

Whether you’re a beginner seeking guidance or exploring the best options to grow your portfolio, understanding different categories can help you make informed decisions aligned with your financial goals.

In this beginner’s guide, we’ll break down the main types of investments and highlight what makes each unique.

Broad Market Index Funds

Broad market funds aim to capture a large portion of an investable market, including bonds, stocks, and other assets. By investing in a wide range of companies across various industries, these funds offer excellent diversification.

They are highly regarded within the investment community for providing steady, long-term growth while managing risk effectively. This guide will explore some of these index funds and their key benefits.

Investing in broad-market options spreads risk across different sectors, helping to balance the volatility of individual stocks. This approach offers a more stable solution for navigating market fluctuations and economic uncertainties.

Popular choices include the Vanguard Total Stock Market ETF, Schwab U.S. Broad Market ETF, and Vanguard Total Bond Market ETF. These funds are widely preferred for their comprehensive market exposure and suitability for diversified investment strategies.

What do you think about Index Funds Investment?

Market Cap Index Funds

Market cap funds group companies by their market capitalization, which represents the total value of a company’s outstanding shares. These funds are essential components often highlighted in investment guidebooks.

Companies are categorized into small-cap, mid-cap, and large-cap groups based on their market values, helping investors diversify across different market segments. Let’s take a closer look at these categories:

Small-Cap Funds

These funds focus on companies with a market capitalization below $2 billion. Known for their potential to deliver significant growth, they also carry higher risks and volatility compared to larger companies. Small-cap funds are a popular choice for investors seeking exposure to emerging or rapidly growing businesses.

Mid-Cap Funds

Targeting companies that fall between small-cap and large-cap thresholds, mid-cap funds offer a balance of growth potential and risk. These index funds are ideal for those looking for moderate growth opportunities while diversifying their investments across a broader range of companies.

Large-Cap Funds

Large-cap funds invest in companies with a market capitalization exceeding $10 billion. These funds focus on well-established, stable businesses capable of withstanding market fluctuations. Because of their stability and lower volatility, large-cap funds are considered foundational investments in diversified portfolios.

Examples of popular funds in these categories include the Fidelity 500 Index Fund, Vanguard Mid-Cap ETF, and iShares Russell 2000 ETF. These options cater to a variety of growth and risk preferences, making them versatile choices for investors.

What do you think about Index Funds Investment?

Equal Weight Index Funds

Stock funds are mostly measured based on their market cap. This means companies worth the most make up bigger percentages of the fund’s portfolio. The risk in this is that a company can become overvalued and account for a large portion of a fund’s assets. To prevent this, equal weight ensures all holdings in a fund contribute about the same percentage of fund assets.

In other words, if an index fund has 100 holdings, each holding will account for roughly 1% of the total portfolio. Examples of equal-weight funds include Invesco S&P 500 Equal Weight ETF and Direxion Nasdaq-100 Equal Weight Index Shares. They are often featured in any index funds guidebook as profitable options for investors. Equal Weight Funds provide unique advantages, especially for people looking for index funds for beginners’ guides. By avoiding too much concentration in any single stock, Equal Weight funds offer a more stable investment option and reduce the effect of the volatility of individual stocks on overall portfolio performance.

Investors looking to manage risk while exploring broad market exposure can consider Equal Weight funds as a top choice.

What do you think about Index Funds Investment?

International Index Funds

If you’re seeking an exciting investment opportunity that provides exposure to regions beyond your own, this is a great option. It allows you to invest in a range of portfolios through a single fund.

International index funds are particularly useful if you’re optimistic about the economic outlook of a region but lack detailed knowledge of individual companies there.

By investing in these funds, you can allocate part of your portfolio to international markets, enhancing diversification and potentially increasing your returns.

These funds are excellent for accessing fast-growing economies, such as those in the Asia-Pacific region and other emerging markets. They offer a straightforward way to benefit from the growth potential of these economies without needing to manage individual investments.

Some popular options in this category include the Vanguard FTSE Emerging Markets ETF, Fidelity Zero International Index Funds, and iShares Core MSCI Total International Stock ETF.

These funds are frequently recommended for their broad exposure to international markets and their ability to diversify portfolios. They are also perfect for beginners, offering an easy and effective way to invest globally.

What do you think about Index Funds Investment?

Debt Index Funds

In addition to investing in stocks, debt index fund investment is another effective way to diversify your portfolio. Also known as fixed-income index funds, these funds track bond indices as stock index funds monitor popular stock market indices.

Through this, they offer low-expense ratios compared to actively managed funds. This makes them an attractive option for cost-conscious investors, including those looking for index funds for beginners.

Let’s mention this: adding bonds to your investment portfolio is a smart strategy, especially as you approach retirement. These investments offer steady income and reduced volatility, which can help even out the more unpredictable nature of stock investment.

Debit index funds are often highlighted in the index funds guidebook for their role in steadying portfolios and offering reliable returns.

Some popular examples include the Vanguard Long-term Bond ETF, the iShares 1-5 Year Investment Grade Corporate Bond ETF, and the Fidelity Municipal Bond Index Fund.

These are considered top funds in the fixed-income category. They offer investors a wide range of options, from long-term bonds to shorter-term municipal bonds and investment-grade corporate bonds.

What do you think about Index Funds Investment?

Sector-based Index Funds

Sector-based index funds focus on specific sectors or industries of the economy, including technology, finance, or healthcare.

Instead of tracking the whole market, these funds invest in companies in a particular sector. With this investment approach, investors can target areas they believe will perform well.

Examples include Fidelity MSCI Financials Index, Vanguard Communication Service Index Fund, and the Consumer Discretionary Select Sector SPDR Funds.

It’s important to remember that this investment option can be more volatile because they are not as diversified as broader index funds.

However, investing in these funds can be a great way to take advantage of the growth in specific industries. We recommend that you do your research and understand the risks involved before investing in it.

What do you think about Index Funds Investment?

#4. How to Get Started with Index Funds Investment

Are you ready to invest in index funds? Getting started is actually simple. All it takes is a few steps and you can start building a diversified portfolio that works for you. Here’s a guide on how to get started. :

Step 1: Sign up for a brokerage account: Various online platforms offer user-friendly interfaces and low investment costs.

This makes it easy to open an account, buy index fund shares, and sell them when the time is ripe. As mentioned, research the platform you want to use before signing up with any brokerage firm.

Step 2: Select an Index Fund to invest in: Before choosing, take the time to establish your investment goals and risk tolerance. Next, research the different funds that align with these.

Some factors you should consider include management fees, past performance, and index tracking. Some popular options are total market, target-date retirement funds, and S&P 500.

Step 3: Fund your Account to Invest: Once you have made your selection, the next step is to transfer money into your brokerage account from your bank account.

Next, buy the shares of your selected index funds investment by following the promptings on the brokerage platform. Some platforms offer automatic investments, which simplifies the process.

#5. How Much Money do You Need to Invest in Index Funds?

The great thing about these passive income opportunities that we have been discussing is their accessibility. You can start with as little as $100, depending on your chosen platform and fund.

This low cost makes it a good choice for beginner investors looking to experiment before investing larger amounts.

#6. How Much Time Does It Require to Start?

This is the best part about investing in index funds. Apart from the initial time spent on research, choosing a brokerage, and selecting the right funds, you don’t need to invest any time in managing your investment.

You can set up automatic investment and portfolio allocation at the initial investment phase. After this, your investment requires little to no involvement from you.

When you sign up for affiliate marketing, you get a unique link. When someone clicks on your link and buys from the company, the company knows you sent the customer, and you get a reward. This reward is usually a percentage of the sale made by the customer

#7. Platforms to Access Index Funds Investment

Choosing the right platform for your index funds investment is important for a smooth and successful investment experience.

With numerous options available, it’s important to find a platform that offers ease of use, low fees, and extensive tools to help you manage your investments.

In this section, we’ll look at some of the top platforms where you can access and invest in these opportunities. Let’s get started!

Vanguard

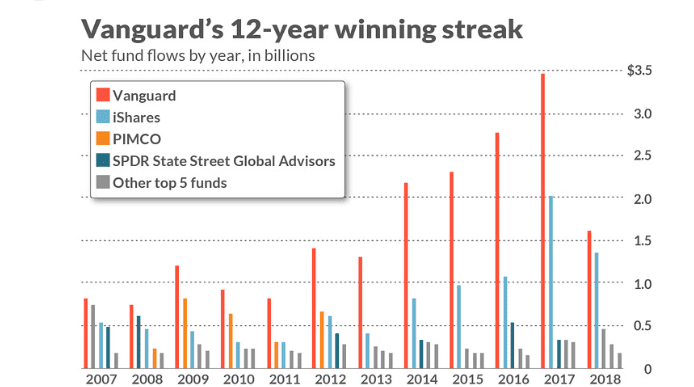

Vanguard is the largest mutual funds issuer globally. It is also the second-largest exchange-traded funds issuer.

The founder, John Bogle, started the first index fund in 1975, tracking the S&P 500. The company charges low fees, which are attractive to many investors.

Vanguard uses a passively managed index-sampling technique to monitor a benchmark index, depending on the fund’s asset type. It then charges expense ratios for managing the index fund.

Pros of Vanguard:

- Has an undisputable reputation

- The platform has beginner-friendly resources and tools for long-term investment

- An extensive selection of mutual funds

- Offers commission-free stock, ETF trades, and options

- Above average order execution quality.

Cons of Vanguard

- Has no stock research, and limited information is available on the platform.

- Poor functionality on the mobile app compared to the desktop site.

- Users have to wait to get an order entry before seeing stock quotes.

Robinhood

Robinhood is another reputable investment platform for index funds investment offering commission-free trading on ETFs, stocks, crypto, and options. The platform is easy to use with a streamlined platform on both the desktop site and mobile app.

It is worth mentioning that Robinhood was the first renowned brokerage platform to remove commissions on options and stock trading.

Pros of Robinhood:

- No account minimum or monthly fee to open or maintain an account.

- It is super easy to use.

- No fees for foreign transactions, card replacements, or transfer

- Offers high-interest cash option

- Offers a competitive 5% APY on uninvested cash on gold tier subscription.

Cons of Robinhood

- Absence of custodial or joint brokerage accounts

- Does not offer mutual funds or bonds.

- The mobile app encourages regular active trading and margin trading. This is a high risk for new investors.

- Customer support is limited as the platform does not offer live chat or direct phone support.

- Limited educational resources, research, and trading tools

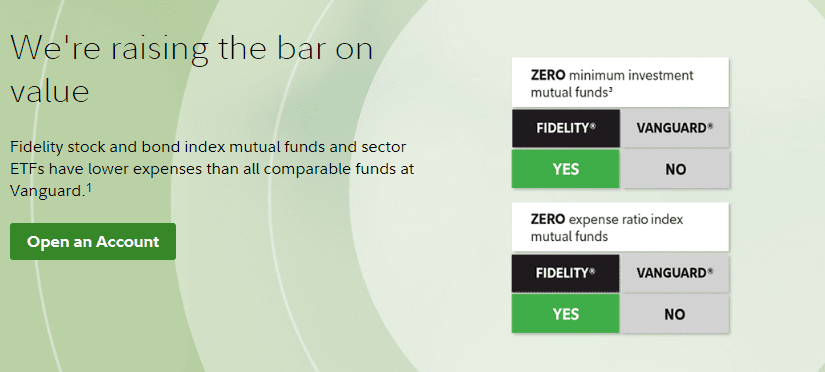

Fidelity

Fidelity offers some of the lowest prices in Index Funds investment. It provides a comprehensive brokerage portfolio with no commissions on ETF trades and stocks.

Fidelity has a huge selection of over 3,300 free transaction-fee mutual funds with an impressive mobile platform and research tools.

It was established in 1946 and is regulated by the FINRA and SEC in the USA. It’s worth mentioning that Fidelity has a clean track record with no major regulatory incidents.

Pros of Fidelity

- Offers commission-free ETFs and stocks

- Exceptional trading platform with research tools

- Offers US and international stocks

- Excellent customer support service

- High interest rate on uninvested cash

Cons of Fidelity

- Slower account verification

- High mutual fund fees and margin rates

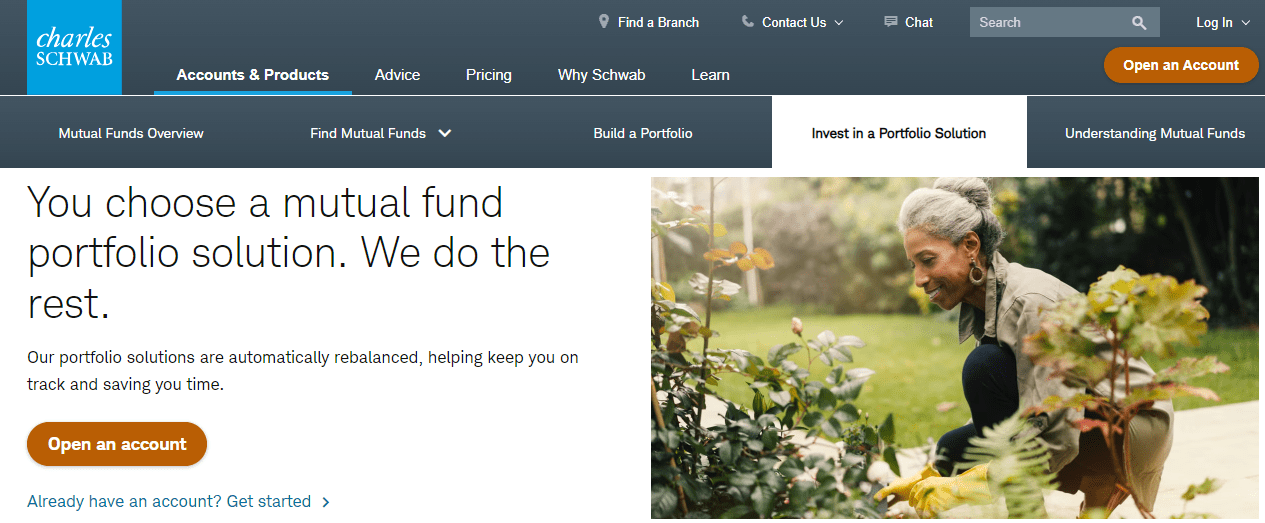

Charles Schwab

Established in 1971, Charles Schwab is one of the largest stockbrokers in the United States. It is indeed one of the best platforms for index fund investors interested in commission-free ETF trading and stock. In addition to ETFs and stocks, the platform also offers funds, options, futures, and bonds.

Opening an account is easy on the site, with no minimum deposit for residents of the United States. However, non-US residents have a minimum deposit requirement of $25,000, which is a major drawback for the platform.

Pros of Charles Schwab:

- Free ETF, options, and stock trading

- Outstanding research tools

- Extensive fund selection

- Excellent customer support service

Cons of Charles Schwab:

- A low interest rate for uninvested cash

- High fees for some mutual funds

- Has only US and Canadian markets

#8. Factors to Consider when Choosing the Right Platform for Index Fund Investments

When it comes to investing in index funds, choosing the right platform is important for maximizing your return and ensuring a seamless investment experience. The above-mentioned platforms each offer unique advantages.

However, it’s crucial to choose one that best fits your needs. Here are some key factors to consider when deciding on a platform to invest:

- Fees and Commissions: Look for a platform that offers low or zero fees for account maintenance and trading. High fees can eat into your returns over time.

- Ease of Use: Consider choosing a platform with a user-friendly and intuitive interface. This ensures a seamless management of your investments and makes it easier to stay on top of your portfolio.

- Investment Options: Ensure that the platform offers a wide range of funds that align with your investment goals. Some platforms might even have exclusive funds that could be a great benefit to your strategy. You can only know this when you diligently check the available options before investing.

- Research and Tools: Your preferred platform should have quality investment tools, research, and educational resources to help you make informed decisions. Take the time to check if the platform offers these features.

- Exceptional Customer Service: Reliable customer service is crucial when investing in any platform. When you encounter issues with your account, customer service should be prompt in responding to your inquiries and solving your issues. Look for platforms known for excellent customer service.

-

Minimum Investment Requirements

Some platforms have minimum investment thresholds. Ensure that your chosen platform aligns with the amount you are ready to invest.

- Reputation and Security: Choose an investment platform with a strong reputation and high-security measures to protect your personal information and investments.

- Mobile Accessibility: If you plan to manage your investments on the go, check if your chosen platform has a good mobile app with all the necessary features you need.

Considering these factors will help you in choosing a platform that best suits your needs and improves your investment experience.

#9. What to Consider Before Investing in Index Funds: What are the Risks?

Before investing, it’s crucial to understand the potential risks involved. While they offer many benefits, no investment is without its challenges. Let’s explore the risks you should consider to make informed decisions.

- Your Investment Appetite: Index funds are perfect for individuals looking for long-term investment opportunities that span at least five years. If you are looking for short-term returns, this type of investment is not for you.

- Establish Your Risk Tolerance: Although funds are diversified, every investment has some associated risks. They are subject to market risk and inflation, and the tide can go either way. You must understand your risk tolerance and choose a fund that fits it.

- Associated Fees: There are dozens of brokerages so it’s important to compare different platforms and check their expense ratios. The goal is to get a low-cost fund to increase your earning potential.

Conclusion

Investing in index funds is a great way to earn passive income, whether you are a new or experienced investor. They offer a low-cost, hands-off, and diversified approach to building wealth over time.

In this post, we’ve covered the fundamentals of this type of investment opportunity, including understanding the basic concepts, the potential returns, the different types available, and how to get started.

We also looked at how much money you need to invest, the time required to start, the top platforms to access these investments, and important factors to consider before investing. With these, you can now diversify your investment portfolio.

With these, you should have a good understanding of how you can add index funds to your investment portfolio.

Like other investments, it’s essential to do your research, understand your financial goals, and choose the best funds that suit your needs.

With the wealth of resources at your disposal, you’re well-equipped to start your investment journey. You should remember that the key to success is patience and consistency.

Apart from index funds, there are many other interesting opportunities to earn passive income. Check out the 26 Passive Income Ideas to Build Wealth 2026 to get a complete lowdown on them.

#10. What Resources are Available for Guidance?

If you are interested in investing in index funds, here are some resources that will guide you through the learning process:

- The Motley Fool: https://www.fool.com/investing/how-to-invest/index-funds/

- Schwab: https://www.schwab.com/schwab-index-funds-etfs

- Vanguard: https://investor.vanguard.com/investment-products/index-funds

- Investopedia: https://www.investopedia.com/terms/i/indexfund

- Bankrate.com https://www.bankrate.com/investing/best-index-funds/#how-to-inve

- Bankrate.com https://www.bankrate.com/investing/types-of-index-funds/#broad-market-index-funds

Links to Platforms to Access Index Funds Investment Opportunities

E-books are digital versions of traditional books. They are designed to be read on electronic devices, such as smartphones, e-readers, and tablets. E-books offer a portable and convenient way to access stories and information.