Do you desire financial freedom? Learn 26 exciting passive income ideas to get rich even when you are asleep. Read to know more.

Top passive income ideas to build wealth even while you are asleep! Comprehensive list of passive and semi-passive opportunities for your review.

Achieve Financial Freedom

Passive income ideas are delights to everyone. We all love the idea of earning money even without putting in much effort. Of course, the appeal of passive income is powerful, and we are all interested. Well, it doesn’t have to be a dream. It’s possible to earn passive income without doing so much.

Whether you are a complete beginner or you have previously had a stint in investment, there are many opportunities to explore. If your desire is to gain financial freedom and build wealth, the top 26 passive income ideas outlined in this post can help you.

Let’s walk you through the opportunities and everything you need to know.

Passive income ideas are delights to everyone. We all love the idea of earning money even without putting in much effort. Of course, the appeal of passive income is powerful, and we are all interested. Well, it doesn’t have to be a dream. It’s possible to earn passive income without doing so much.

Whether you are a complete beginner or you have previously had a stint in investment, there are many opportunities to explore. If your desire is to gain financial freedom and build wealth, the top 26 passive income ideas outlined in this post can help you.

Let’s walk you through the opportunities and everything you need to know.

Frequently Asked Questions (FAQs)

Unlike traditional jobs, where you spend hours daily to earn an income, passive income allows you to grow wealth over time through investments that work independently. It’s like planting a seed where you put in the initial effort.

With this hands-off approach, you can reclaim your life and time, pursue your passions, and attain the financial security you desire.

There are several passive income ideas out there. Your goal is to find the perfect option that aligns with your interests and resources. Don’t worry, we’ll guide you through the step-by-step process on how to explore these passive income ideas.

There are many reasons to consider building wealth through passive income Ideas.

Here are some of them:

● Financial freedom and security

Passive income significantly reduces your dependence on your paycheck. This creates a safety net in case you lose your job during the economic downturn. Additionally, with enough passive income, you can cover your expenses and upgrade your lifestyle. Of course, you can retire early when you have enough money to live on.

● Peace of mind

How do you feel when it is time to pay your bills with your current pay check? We understand the feeling. It can be nerve-wracking, especially when the income can barely cover the expenses. Exploring passive income ideas removes this financial stress and anxiety because you have something extra coming in from other sources.

Although passive income has attractive benefits, it is crucial to understand its limitations before getting into it.

Let us look at some critical factors that may seemingly make passive income opportunities unattractive.

● High initial investment

Many passive income opportunities require a huge upfront investment in money, resources, and time. This can be a limitation for people with limited resources.

● Lack of control

There are external forces that can affect passive income. These include market fluctuations, tenant issues (if you invest in property rentals), or platform changes for online investments. All these make passive income earnings less predictable compared to traditional employment.

● Limited earning opportunities

Compared to your regular job, where you earn based on your expertise and efforts, passive income often has slower growth rates. You may need to make a significant upfront investment to earn more and it may also take longer to reach your desired income level.

● Time commitment

While passive income is dubbed effortless, building and sustaining your passive income streams sometimes require initial setup costs, ongoing maintenance, and adaptation to developing scenarios.

Of course, the level of time commitment required depends largely on your chosen passive income option.

While the attraction of passive income is undeniable, it comes with its limitations, as described above. So, how do you work around these limitations so you can benefit from the various passive income opportunities available?

You need to research, plan, and develop strategic approaches to mitigate these limitations.

● Research Passive Income ideas before investing

Do not jump into an investment without doing your due diligence. Take the time to understand the different opportunities available to you and research their potential earning.

It is also a good idea to check historical data about your preferred investment and seek expert advice. After deciding on an investment, do not go straight into it. Take the time to compare platforms, features, offerings, and fees before committing your funds.

● Plan your investment

Instead of investing a large amount, start small and grow your investment.

Diversify your portfolio by doing 3 or more different income sources and platforms to mitigate the risks and increase profitability.

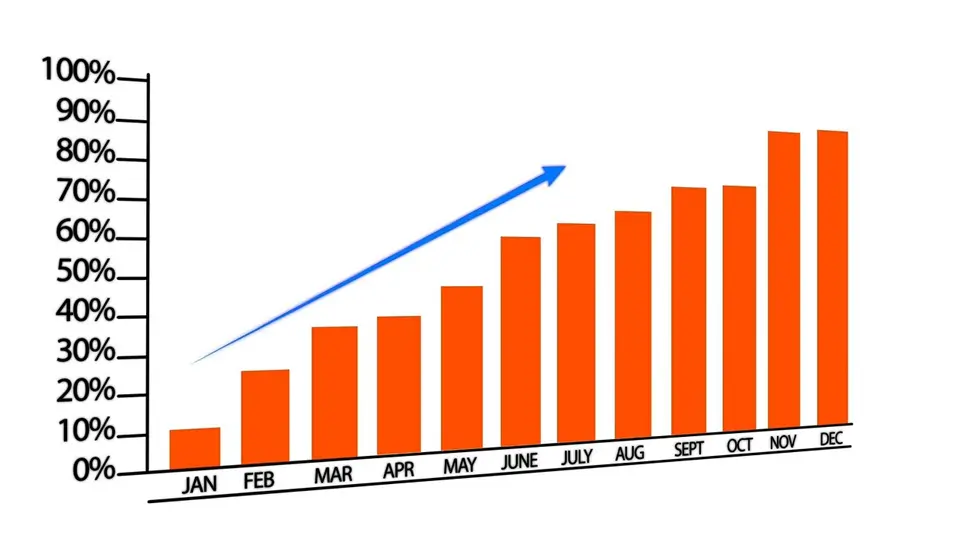

Also, set achievable financial goals with realistic timelines. Remember, it is called a passive income investment and not a get-rich-quick scheme

Types of Passive Income Ideas to Explore

We have categorized passive income ideas into two to enable you to make informed decisions. These are Fully Passive Income and Partial Passive Income.

Fully Passive Income Ideas

These require little to no ongoing effort. It is a great choice for individuals looking for additional streams of income without going beyond their initial investment. Let’s explore different fully passive income ideas in detail.

1. Index Funds Investment

Index funds are a minimal-effort, long-term passive income opportunity that tracks specific market index performance. When you invest in an index fund, you’ve technically bought a piece of each company in that index.

With this, you diversify your investment and significantly reduce the associated risk with individual stocks. An index fund is primarily an invest-and-forget-it investment concept, and if you are looking for long-term passive income ideas, this is a good option for you.

How Much Money do you Need to Invest in Index Funds?

The great thing about these passive income ideas is their accessibility. You can start with as little as $100, depending on your chosen platform and fund. This low cost makes index funds a good choice for beginner investors looking to experiment before investing larger amounts.

How Much Can You Potentially Make?

How Much Time Does It Require to Start?

This is the best part. Apart from the initial time spent on research, choosing a brokerage, and selecting the right funds, you don’t need to invest any time in managing your investment. You can set up automatic investment and portfolio allocation at the initial investment phase. After this, your investment requires little to no involvement from you.

Pros and Cons:

- Pro: Diversified investment with low management fees and steady long-term returns.

- Con: Returns are tied to market performance and may fluctuate.

2. Invest in Real Estate Investment Trusts (REITs)

What are REITs?

Real Estate Investment Trusts, REITs, offer investors an opportunity to own income-generating property portfolios without actually owning and managing the property. REITs are organizations that own, operate and finance income-generating real estate.

They pool capital from various investors and distribute a large percentage of their taxable income as dividends. REITs offer new investors exciting passive income ideas. Investing in REITS gives you exposure to the real estate market without the hassles of direct property ownership and management.

How Much Money Do You Need to Start?

The minimum investment amount in these passive income opportunities depends largely on your chosen REIT and brokerage platform. Some platforms allow users to start with as low as $1000, while others require higher investment, up to $50,000 or more.

How Much Can You Potentially Make with Passive Income ideas?

Potential returns on REITs depend on the market conditions and your chosen REIT. However, you can expect between 3% and 8% dividend yields with possible capital appreciation. Of course, it can be more, depending on several factors.

Pros and Cons:

- Pro: Provides access to real estate investments without owning property, offering regular dividends.

- Con: Market volatility and fees can impact returns.

3. Invest in CafeXbot Robotic Café

If you are conversant with robotic café, there is a high chance you have come across, or at least heard of CafeXbot Robotic Café. So, what is it? CafeXbot is a robotic café designed to offer fully automated solutions for coffee, tea, snacks, and ice cream.

Developed by VLT Robotics, this innovative café uses AI and robotics to prepare and dispense menu items without the service of humans. Investing in a CafeXbot is undoubtedly one of the best passive income ideas you can explore. All you need is a perfect location with high foot traffic, and you can generate passive income from product sales without any human element.

How Much Money Do You Need to Start?

CafeXbot Robotic Café is a bit capital intensive, but the reward is very attractive. The amount you need to get started depends on your preferred CafeXbot Robotic Café model. However, you can budget between $60,000 and $100,000 for the purchase.

Does This Passive Income idea Require Time Investment?

The only time investment is at the initial setup stage, where you collaborate with the VLT team and make your decision. After the setup, there is little to no ongoing management. The company also offers operational service for a fee, which takes the management and operations off you entirely.

Pros and Cons:

- Pro: High-tech investment with potential for significant growth in the automation and hospitality industry.

- Con: High initial capital required and risks associated with emerging technologies.

4. Invest in Robo-Advisors

What are Robo-Advisors and how do they rank as passive income ideas? Robo-Advisors are automated investment online platforms. These platforms use algorithms to manage users’ portfolios according to their risk tolerance and financial goals.

Unlike human advisors, Robo-Advisors perform their functions digitally with little to no human intervention. Since everything on the platforms is automated, the investment process is convenient and low-cost.

How Much Money Do You Need to Start?

The actual investment capital depends on your chosen Robo-advisor. The minimum capital ranges from $100 to $2000. We recommend that you check the requirements of your preferred platform before investing in passive income ideas.

Does This Passive Income idea Require Time Investment?

The time investment is highly minimal. As a fact, you only need to invest time during the initial setup, which entails selecting a platform to sign up with and funding your account. After these, you do not need to do anything. The core investment strategy is managed automatically by the platform.

Pros and Cons:

- Pro: Fully automated, low-cost portfolio management with minimal effort required.

- Con: Limited customization compared to human financial advisors.

What do you think about Robo-Advisors Investment?

5. Put Your Money in a High-yield Savings Account

Saving money is important. However, keeping it in a traditional savings account is not a good way to earn from passive income ideas. The best way to earn through savings is to put your money in a high-yield savings account.

What are High-yield Savings Accounts?

High-yield savings accounts are high-interest-generating accounts offered by banks. They generally offer interest rates that are many times higher than traditional savings accounts.

Currently, high-yield savings accounts pay between 2% and 5.10% Annual Percentage Yield. Investing in this ensures your money grows faster and generates high passive income opportunities. This is a better option for investors with low-risk tolerance.

How Much Money Do You Need to Start?

The great thing about a high-yield savings account is its low-barrier entry. Many platforms have no minimum deposit, which means you can deposit any amount you want. However, it is important to note that your investment amount will determine your earnings at the end of the day.

These passive income ideas also give you easy access to your money when you need it.

Does it Require Your Time Investment?

High-yield savings accounts require minimal ongoing maintenance and, by extension, little to no time investment on your part. After the initial investment, the savings platform automates the process and requires nothing of you.

Pros and Cons:

- Pro: Guaranteed returns with low risk and easy access to funds.

- Con: Lower interest rates compared to other investment options.

What do you think about high-yield Saving Account Investment?

6. Buy a Rental Property: One of the Best Passive Income Ideas

Buying a rental property is a classic example of passive income ideas, offering consistent cash flow through tenant rent payments. This strategy allows property owners to benefit from consistent monthly cash flow while potentially increasing their wealth through property appreciation.

Rental properties can also provide tax advantages, as expenses like mortgage interest, maintenance, and property management fees are often deductible. For those looking to maximize their passive income ideas, investing in properties in high-demand areas with strong rental markets can lead to significant returns over time.

How Does It Work?

You purchase a property and rent it out to tenants, collecting monthly rental payments. This provides a steady stream of passive income while the property’s value appreciates over time. Additionally, rental properties can offer tax advantages and potential long-term wealth-building opportunities.

What Is the Initial Investment and Time Commitment Required?

To buy a rental property, you’ll typically need a 20% down payment, closing costs, and funds for any necessary renovations. For example, purchasing a $250,000 property may require an initial investment of $50,000 or more. Significant time is required upfront for researching properties, evaluating market conditions, and finding tenants. Once the property is set up and rented, the ongoing time commitment can be minimized by hiring a property management service.

Pros and Cons:

- Pro: Consistent income with the potential for property appreciation.

- Con: High upfront costs and risks such as tenant default.

What do you think about Rental property Investment?

7. Solar Farm Leasing: One of the Sustainable Passive Income Ideas

What it is: Leasing land for solar farms allows landowners to earn passive income ideas while contributing to sustainable energy solutions. This innovative opportunity not only provides a steady income stream through long-term lease agreements but also aligns with environmental goals by promoting renewable energy.

Solar farms require minimal landowner involvement, presenting one of the most sustainable passive income ideas available, as the energy company typically handles installation, maintenance, and operational responsibilities.

How Does It Work?

You lease your land to energy companies, who install and maintain solar panels. This creates a passive return in the form of lease payments over 20–30 years.

What Is the Initial Investment and Time Commitment Required?

Minimal costs if you already own the land. Installation and maintenance are typically handled by the energy company.Virtually none after signing the lease agreement, making it one of the most hands-off passive income ideas.

Pros and Cons:

- Pro: Eco-friendly and long-term income with little effort.

- Con: Requires suitable land in high-sunlight areas.

What do you think about Solar Farm Leasing Investment?

8. Invest in Vending Machines

What it is: Investing in vending machines is a simple passive activity that generates income from product sales in high-traffic locations. These machines can be stocked with a variety of items such as snacks, beverages, or even niche products like health supplements. The key to success lies in selecting strategic, high-footfall areas like office buildings, schools, gyms, or malls, where demand is constant.

Modern vending machines also offer cashless payment options, enhancing user convenience and increasing sales. Investing in vending machines is one of the simplest passive income ideas, scalable by increasing the number of machines in multiple locations, creating a robust passive income ideas.

How Does It Work?

Purchase vending machines, stock them with popular products, and collect profits. Restocking and maintenance can be outsourced for a fully passive investment.

What Is the Initial Investment and Time Commitment Required?

Expect to spend $3,000–$7,000 for the machine, inventory, and permits.Minimal if outsourced, though you’ll need time for setup and securing prime locations.

Pros and Cons:

- Pro: Scalable with the ability to own multiple machines.

- Con: Profitability depends on location and product demand.

What do you think about Vending Machine Investment?

9. Invest in Bonds or Bond Funds

What it is: Investing in bonds or bond funds is one of the most reliable passive income ideas, providing steady interest payments and financial security. Bonds act as fixed-income investments where you lend money to governments, corporations, or municipalities in exchange for periodic interest payments, known as coupons. This consistent flow of income makes bonds a popular choice for conservative investors.

Bond funds, on the other hand, pool investments across multiple bonds, diversifying risk while maintaining stable passive income ideas. With various options such as Treasury bonds, municipal bonds, and corporate bonds, investors can tailor their portfolios to match their financial goals and risk tolerance.

How Does It Work?

Bonds act as loans you give to governments or corporations in exchange for regular interest. Bond funds diversify across multiple bonds for added security.

What Is the Initial Investment and Time Commitment Required?

Individual bonds start at $1,000, while bond funds can require as little as $100–$500.Once purchased, bonds need no management, offering predictable passive income ideas.

Pros and Cons:

- Pro: Reliable and low-risk income.

- Con: Lower returns compared to higher-risk investments.

What do you think about Bonds or Bond funds Investment?

10. Build a SaaS Product: One of the Most Profitable Passive Income Ideas

What it is: Passive income ideas like creating a SaaS product involve developing software solutions offered as a subscription-based service. This passive income idea allows you to target businesses or individual users with scalable and recurring revenue potential.

A successful SaaS product addresses a specific need or solves a problem, offering features like automation, analytics, or user collaboration. With a one-time development effort, SaaS products can generate consistent passive income returns over time.

How Does It Work?

Develop a software product, host it online, and offer it as a subscription service. Examples include productivity tools, CRM software, or cloud storage solutions.

What Is the Initial Investment and Time Commitment Required?

Development costs range from $5,000 to $50,000, depending on complexity.Significant initial effort during development, but ongoing operations require minimal passive activity.

Pros and Cons:

- Pro: Scalable revenue and high passive income ideas return potential.

- Con: High upfront costs and competitive market.

What do you think about SaaS Product Investment?

11. Invest in EV Charging Stations

What it is: Passive income ideas like EV charging stations are becoming increasingly popular due to the growing demand for electric vehicles. This involves setting up charging stations in high-traffic areas or partnering with businesses to host chargers. As EV adoption rises, well-placed charging stations can generate steady passive income ideas while supporting a sustainable future.

How Does It Work?

You install EV charging stations in high-traffic or strategic locations, such as parking lots, shopping centers, or residential complexes. Revenue is generated through per-use fees paid by EV owners or subscription plans for regular users. As the demand for electric vehicles grows, this investment provides a sustainable and scalable passive income opportunity.

What Is the Initial Investment and Time Commitment Required?

The installation costs for EV charging stations typically range from $5,000 to $50,000 per station, depending on the type of charger and its features. After installation, the time commitment is minimal, as ongoing maintenance and monitoring can often be outsourced to service providers. This makes it a low-maintenance investment with long-term income potential.

Pros and Cons:

- Pro: Growing market demand and sustainability focus.

- Con: High setup costs and location dependency.

What do you think about EV Charging Station Investment?

12. Invest in Data Centers

What it is: Data centers are a critical part of the digital infrastructure, making them a lucrative passive investment. By investing in or owning shares of data centers, you tap into the growing demand for cloud services, big data analytics, and AI. This passive income idea involves leasing server space to businesses needing reliable data storage and processing solutions. With the rise of IoT and edge computing, data centers represent long-term passive income ideas.

How Does It Work?

You can partner with or invest in companies that own and operate data centers, earning revenue through dividends or leasing income. Data centers lease server space to businesses for data storage and processing needs, providing you with a consistent and scalable passive income stream. As demand for cloud computing and digital services grows, this investment offers long-term profitability.

What Is the Initial Investment and Time Commitment Required?

The costs for investing in data centers typically range from $10,000 to $500,000, depending on the scale and type of investment, such as shares in a data center company or direct ownership of server space. After the initial investment, the time commitment is minimal, as revenue is generated passively through leasing agreements or dividends, requiring little ongoing involvement from you.

Pros and Cons:

- Pro: Stable demand and high scalability.

- Con: High capital requirement and technical knowledge needed.

What do you think about Data Centers Investment?

Partially Passive Income Ideas

Partially passive income ideas have many benefits with ongoing income over a long period. However, they do require a bit of effort on your part.

Are you interested in earning passive income without giving up your regular job? This guide offers comprehensive details on five partially passive income opportunities to explore. Let’s get right into the details!

13. Affiliate Marketing

Affiliate marketing is one of the top partially passive income ideas in the digital space today. It is about promoting a company’s product or service on your blog, social media, or website to earn passive income.

When you sign up for affiliate marketing, you get a unique link. When someone clicks on your link and buys from the company, the company knows you sent the customer, and you get a reward. This reward is usually a percentage of the sale made by the customer

How Much do You need to Start with this Partially Passive Income idea

Affiliate marketing is one of the popular partially passive income ideas to invest in and earn in the long term. While you can start this with no money, it is not scalable. You cannot make a decent passive income without investing in affiliate marketing. A domain costs an average of $10 for the first year, and a host can cost about $33 per annum.

You also have to consider the website design. Of course, if you are a DIY person, you can find resources online to help you create a good website or landing page. Also, consider the cost of running campaigns to drive traffic to your page, which can cost about $300 for a few months. On average, you can anticipate investing about $700 to start your affiliate marketing business.

How Much Time Does It Require to Start and Maintain It?

The time investment for partially passive income opportunities varies. For affiliate marketing, the time requirement covers startup and maintenance. The startup time varies greatly and can range from weeks to months for creating blogs and your first content.

Maintenance requires ongoing effort, and you can expect to invest about five to twenty hours per week, depending on your skills and desired earnings.

Pros and Cons:

- Pro: Scalable income potential with no need to create your own product.

- Con: Requires consistent effort to build and maintain an audience.

14. Sell Digital Products

Partially passive income ideas you can also explore include selling digital products. Are you passionate about design, writing, or creating valuable resources? You can turn your knowledge and passion into earning opportunities by selling digital products. In this section, we’ll explore all about selling digital products and how to get started right away.

What are Digital Products?

Digital products are intangible products available in digital formats. They can be accessed online or downloaded. These products offer a cost-effective and convenient way to share your skills, creative work, and knowledge with a global audience. Some examples of digital products are templates and printables, webinars, stock photos, music, graphics, and digital printables.

How Much Money Does It Require to Avail this Passive Income idea?

Digital products have low capital investment. So, how much do you need to start these partially passive income ideas? Let’s break it down. You need about $36 to $100 annually to get a domain name and website hosting to showcase your digital products and establish an online presence. Platform fees are other variable costs you should plan for.

Optional costs include content creation tools like design software, editing tools, and marketing. On average, you should consider investing about $150 to $300 for a start in these partially passive income opportunities.

How Much Time Does It Require to Start and Maintain It?

The time required to start and maintain these partially passive income ideas varies and depends on many factors. The complexity of the product will determine the time investment. For instance, creating software or an app requires more time than designing templates.

You can invest about one month for the initial startup. After that, you only need to update content, respond to customer inquiries, and evaluate your performance at intervals. The good part is the flexibility. You can dedicate time based on your schedule and business goals.

Pros and Cons:

- Pro: Unlimited scalability with no inventory or shipping costs.

- Con: Highly competitive market requiring strong marketing strategies.

What do you think about Digital Products Investment?

15. Invest in CafeXbot Robotic Café: A Smart Passive Income Idea

What it is: In this model, you purchase a CafeXbot Robotic Café and take full responsibility for its operations. This involves independently managing the entire business, including hiring staff, handling inventory, conducting maintenance, and generating operational reports. While the robotic system automates customer service, the overall management is entirely handled by the owner.

How Does It Work?

You buy the robotic café and assemble your own team to operate it. From setting up the location to daily operations, everything is under your control. The owner is responsible for maintaining the machine, troubleshooting any issues, restocking inventory, and ensuring a seamless customer experience. This hands-on approach provides flexibility to tailor the business as per your vision while utilizing advanced robotic technology for a unique passive income idea.

What Is the Initial Investment and Time Commitment Required?

Initial Investment: The cost of purchasing and setting up a CafeXbot ranges from $60,000 to $100,000, along with expenses for hiring staff, training, and other operational needs.

Time Commitment: This model demands more active involvement, with regular hours dedicated to team management, performance analysis, and hands-on troubleshooting. This makes it a true blend of partial automation and active entrepreneurship.

Pros and Cons:

- Pro: Complete control over business operations, Opportunity to customize and innovate beyond vendor-provided services.

- Con: High involvement in daily management and troubleshooting. Requires additional effort for hiring and training staff.

What do you think about investing in CafeXbot Robotic Cafe?

16. Sell Stock Photos Online

Selling stock photos online is also on our list of partially passive income ideas. Do you have an eye for capturing beautiful photos? Selling stock photos online may be a great opportunity to earn passive income. This section looks at everything you need to know about selling stock photos online. Let’s get right into the details!

What are Stock Photos ?

Stock photos are royalty-free images that are licensed for different commercial and non-commercial uses. These photos are valuable resources for individuals, designers, and businesses looking for high-quality visuals for websites, presentations, marketing materials, and more.

How Much Money Do You Need to Start and Earn from this Passive Income Opportunity?

Selling stock photos online requires minimal initial investment. All you need are equipment, stock photo platform fee payment, and editing software. While you can invest in a high-quality camera, you can get started with your smartphone camera.

For fees, most platforms charge little commission on sales or subscription fees. We recommend using subscription-based editing software so you do not have to deal with watermark issues on your images. On average, you can start selling stock photos online for as little as $50.

How Much Time Does It Require to Start and Maintain It?

The time requirement for selling stock photos online is flexibility. Let’s highlight where you need to invest time to earn attractive income from the partially passive income opportunities. Capturing high-quality pictures, diversifying your portfolio across themes and categories, editing and optimizing photos with relevant keywords, and uploading the photos.

You can invest about three months to get started with building an impressive portfolio and then spend a few hours a week monitoring performance and uploading more photos. The best part is that you can do it at your own pace.

How Much Time Does It Require to Start and Maintain It?

- Pro: Passive income potential from photos that can be sold repeatedly.

- Con: Requires professional-quality photography and significant time to build a portfolio.

17. Teach Online Courses

Online courses are profitable, partially passive income opportunities to explore. They are a good choice for people with valuable knowledge and a passion for teaching. In this section, we’ll share details on how to get started with teaching online courses. Let’s get right into the details!

What are Online Courses?

Online courses are structured learning programs entirely delivered to learners online. These courses offer a convenient and flexible way for individuals to learn new knowledge and skills. Online courses come in different formats, including video lectures, interactive elements, and live sessions.

Investing in these partially passive income ideas helps you reach a global audience, equip learners with new skills, and create a sustainable income stream.

How Much Money Do You Need to Start?

Teaching online courses requires minimal initial cost. Overall, labor is the primary expense, which you do not have to pay since you are creating the learning materials yourself. For software equipment and marketing, you can budget between $200 and $10,000, depending on the quality of equipment you choose.

How Much Time Does Teaching Online Courses Require?

Different factors will contribute to the time commitment required for teaching online courses. These factors include course development and creation, platform setup and management, and marketing.

The initial time required for these partially passive income ideas ranges between a few weeks and a month, depending on the volume of the course and the time required for the editing. For maintenance, you may need only a few hours a day to monitor the course performance and answer questions from students.

Pros and Cons:

- Pro: Passive income potential from photos that can be sold repeatedly.

- Con: Requires professional-quality photography and significant time to build a portfolio.

18. Write and Sell an E-book

Writing and selling e-books is one of the most popular partially passive income ideas in the market today. If you have a wealth of knowledge to share and a passion for writing, you can make a fortune from this opportunity. In this section, we look at all you need to know about writing and selling e-books online.

What is an E-book

E-books are digital versions of traditional books. They are designed to be read on electronic devices, such as smartphones, e-readers, and tablets. E-books offer a portable and convenient way to access stories and information.

How Much Money Do You Need to Start Writing and Selling E-books?

These partially passive income opportunities require minimal capital investment. The main cost is labor, which involves the writing. Other costs you may want to consider are paid editing, cover design, marketing tools, and platform fees.

Although it is difficult to state an actual cost due to different factors, a general estimate to start writing and selling e-books is about $50. However, there are optional costs that cover professional editing, marketing tools, and advanced cover design. For these, you may need between $100 and $500.

How Much Time Does It Require to Write and Sell an E-book?

Different factors will determine the time required to write and sell an e-book. For example, the length and complexity of the book will determine how long it takes to write it. Writing experience, research, actual writing, and editing will also determine the time required to write the book.

On average, the writing and editing time can take between two to six months, depending on the length and complexity. Formatting and publishing can take about one to two weeks, while marketing and promotion is an ongoing effort.

Pros and Cons:

- Pro: Low upfront costs with the potential for passive income over time.

- Con: Requires significant effort initially to write and market the book.

19. Buy and Sell Domain Names

Passive income ideas like domain flipping is one of the more creative opportunities, involving the buying and selling of domain names for profit. This involves identifying undervalued domains or those with high future potential, purchasing them, and reselling them at a higher price. Successful domain flipping often requires a keen understanding of market trends, such as popular keywords, industry shifts, and emerging brand names.

Additionally, domain brokers and auction platforms like GoDaddy Auctions or Flippa facilitate transactions, making it easier for newcomers to enter the market. With a strategic approach, domain flipping can yield consistent passive income ideas over time, including passive income stream, passive investment, and passive opportunities.

How Does It Work?

You identify undervalued or trending domain names with high future potential and purchase them at a low cost. Later, you sell these domains at a higher price to businesses or individuals looking for relevant, catchy domain names. Platforms like GoDaddy Auctions, Flippa, or Sedo simplify the buying and selling process, making it easy to connect with potential buyers and earn profits.

What Is the Initial Investment and Time Commitment Required?

Domains generally cost $10 to $50 annually to purchase and maintain. The initial time investment involves researching undervalued or trending domain names and understanding market demand. While moderate effort is required during the research and listing phase, once a domain is listed for sale, the process becomes largely passive, generating returns when a buyer makes a purchase.

Pros and Cons:

- Pro: Low entry cost and high ROI potential.

- Con: Requires understanding market trends.

What do you think about Buy and Sell Domain Names ?

20. Invest in AI Agents: A Game-Changer for Passive Income Ideas

AI agents are automated tools performing tasks like trading, customer service, data analysis, or even marketing optimization, offering a modern passive investment opportunity. These tools are powered by advanced algorithms and machine learning technologies that allow them to perform tasks autonomously with minimal human intervention.

AI trading bots, for instance, analyze market trends and execute profitable trades without manual input, while AI chatbots handle customer inquiries 24/7, improving efficiency. As businesses increasingly rely on AI, investing in or developing these systems can be one of the most innovative passive income idea available. With customization options, AI agents can be tailored to meet specific needs, enhancing their potential for long-term profitability.

How Does It Work?

You invest in or develop AI systems designed to perform tasks autonomously, such as trading, customer support, or data analysis. For instance, AI trading bots analyze market trends and execute profitable trades without manual intervention. These systems leverage machine learning and automation to generate income, making them a modern and efficient passive income strategy.

What Is the Initial Investment and Time Commitment Required?

Costs range from $1,000 to $10,000 depending on the complexity and functionality of the AI agent. After the initial setup, the time commitment is minimal, as these agents are designed to operate independently with little human intervention. They can perform tasks like customer support, lead generation, or even e-commerce management, making them an excellent passive income idea.

Pros and Cons:

- Pro: Scalable and cutting-edge technology.

- Con: High upfront costs and reliance on tech infrastructure.

What do you think about investing in AI Agents?

21. Start a Dropshipping Store

Passive income through dropshipping is an e-commerce model requiring no inventory, making it a highly flexible and scalable passive income idea. Entrepreneurs create online stores to sell products sourced from suppliers who handle inventory and shipping logistics.

By leveraging automation tools for order processing and marketing, dropshipping minimizes operational tasks. This approach is ideal for those looking to establish a passive income idea with lower startup costs compared to traditional retail.

How Does It Work?

You list products in your store and forward customer orders to suppliers, who handle fulfillment. Profit is earned on the margin between supplier costs and selling prices.

What Is the Initial Investment and Time Commitment Required?

Expect $300–$500 for store setup, domain, and initial marketing campaigns. The setup phase demands effort to source products, create a user-friendly website, and optimize for conversions. However, once established, dropshipping can become a highly passive income stream with automated order fulfillment and minimal ongoing management.

Pros and Cons:

- Pro: Low overhead and inventory-free operations.

- Con: Highly competitive market.

What do you think about starting a Dropshipping Store?

22. Create an App: Unlock Innovative Passive Income Ideas

Passive income ideas through app development involve creating software solutions that generate revenue streams through ads, subscriptions, or in-app purchases. This lucrative opportunity allows creators to tap into the growing app market, providing utility or entertainment to users while earning a steady passive income.

Successful apps often leverage innovative features, engaging designs, and seamless user experiences to attract a wide audience. Developers can further monetize apps by offering premium features or integrating third-party partnerships, increasing the potential for consistent passive returns.

How Does It Work?

You create an app tailored to a specific need or audience, design its features and interface, and launch it on app stores like Google Play or Apple App Store. Income is generated through downloads, in-app purchases, ads, or subscription plans as users engage with your app.

What Is the Initial Investment and Time Commitment Required?

Costs vary from $1,000 to $10,000 depending on app complexity. Low-code platforms reduce costs to $100–$500.Significant effort during development, but income becomes passive dollars after launch.

Pros and Cons:

- Pro: High income potential and scalability.

- Con: High upfront investment and app store competition.

What do you think about Creating an App?

23. Sell Print-on-Demand Products

Print-on-demand is one of the most effective passive income ideas, allowing you to sell custom-designed products like t-shirts, mugs, tote bags, or posters without the need to hold inventory. By utilizing platforms like Printful or Redbubble, creators can upload unique designs that are printed and shipped directly to customers upon order placement.

This removes the hassle of managing stock or handling logistics. As the platform handles production and fulfillment, sellers can focus on promoting their products through social media or e-commerce stores. With low startup costs and automation, print-on-demand offers a scalable and efficient way to build a sustainable passive income.

How Does It Work?

You upload your designs to print-on-demand platforms like Printful or Redbubble, which handle the printing, packaging, and shipping processes. When a customer purchases your product, the platform fulfills the order, and you earn a profit margin on each sale without managing inventory or logistics.

What Is the Initial Investment and Time Commitment Required?

Most platforms are free to join; design creation costs around $10–$50 per design. Time is required for design creation and setup. Operations are largely automated afterward.

Pros and Cons:

- Pro: No inventory or shipping hassles.

- Con: Requires compelling designs and marketing to succeed.

What do you think about Sell Print-on-Demand Products?

24. Become an AI Blogger: One of the Most Creative Passive Income Ideas

AI blogging represents one of the newest and most efficient passive income ideas, utilizing tools like ChatGPT and other advanced AI systems to generate, curate, and manage blog content efficiently. This method automates content creation, making it a highly attractive option for individuals seeking to establish a sustainable passive form of making money. AI blogging simplifies the writing process, enabling creators to focus on strategy and audience engagement rather than manual effort.

How Does It Work?

AI tools assist in generating high-quality articles, optimizing content for SEO, and scheduling posts to maintain consistency. Monetization opportunities arise through ad placements, affiliate marketing, and sponsorships, making AI blogging an efficient way to create a passive income stream.

What Is the Initial Investment and Time Commitment Required?

Expect costs for hosting, typically around $100 annually, and AI tools ranging from $20 to $100 per month. While AI significantly reduces the effort required for content creation, you’ll need to invest some time in developing a content strategy, monitoring performance, and occasionally updating posts to maintain relevance and maximize monetization opportunities.

Pros and Cons:

- Pro: Scalable content production for sustained traffic.

- Con: Requires consistent updates to remain relevant.

What do you think about become an AI Blogger?

25. Buy an Existing Website: A Profitable Passive Income Ideas Strategy

Passive income ideas, like purchasing established websites, offer a quick way to generate revenue. Websites with consistent traffic and income from ads, affiliate marketing, or e-commerce can be acquired and managed as passive income ideas. Platforms like Flippa or Empire Flippers make it easy to find profitable websites. By optimizing content or adding new revenue streams, you can increase the site’s profitability over time.

How Does It Work?

You purchase an established website with an existing audience and revenue streams. Monetization can continue through the website’s current methods, such as ads or affiliate links, or you can implement new strategies like selling products or offering subscriptions to increase profitability.

What Is the Initial Investment and Time Commitment Required?

Website prices usually range from $500 to $50,000, depending on factors like traffic, domain authority, and revenue potential. The time commitment is relatively low, requiring periodic updates, monitoring performance, and implementing minor improvements to ensure a steady passive income stream.

Pros and Cons:

- Pro: Immediate income generation and scalable revenue.

- Con: Requires careful evaluation of website performance.

What do you think about Buy an Existing Website?

26. Buy Metaverse Land: A Cutting-Edge Passive Income Ideas Opportunity

Passive income ideas in the digital age include investing in virtual real estate within the metaverse. Platforms like Decentraland and The Sandbox allow users to purchase, develop, and monetize virtual land. This passive activity offers opportunities such as hosting events, renting land to businesses, or selling advertising space. With the metaverse’s growing popularity, owning virtual real estate can yield significant passive income over time.

How Does It Work?

You purchase virtual land on metaverse platforms like Decentraland or Sandbox, which can be developed or leased. Monetization opportunities include building virtual storefronts, hosting events, or renting the space to other users or businesses for passive income.

What Is the Initial Investment and Time Commitment Required?

Prices for virtual land range from $1,000 to $100,000, depending on the platform and the desirability of the location within the metaverse. Time commitment is minimal, as managing virtual properties and monetization strategies, like rentals or advertisements, can often be outsourced or automated.

Pros and Cons:

- Pro: High potential ROI in an emerging market.

- Con: Speculative and reliant on platform growth.

What do you think about Buy Metaverse Land?

Conclusion

That’s a wrap! In this post, we’ve thoroughly explored the essentials of passive income opportunities for building wealth. We examined the reasons to pursue passive income, its benefits and limitations, and suggested strategies to overcome those limitations.

You now need to assess your situation and decide which of these opportunities is best suited for you by taking into consideration your aspirations, capabilities, and interests.

If you’re interested in Real Estate Investment as a passive income source, check out our guide on 10 Top REIT Things to Know – Guidebook for Beginners 2025 to learn how Real Estate Investment Trusts (REITs) can help you grow your wealth.