Are you interested in a real estate portfolio but don’t have the time or resources to buy and manage properties on your own? A REIT offers a great way to invest in real estate investment trusts (REITs) without the stress of property management.

In this comprehensive guide, we’ll explore the world of real estate investment trusts and show you how they work, the different types available, and the potential benefits and risks.

Whether you are looking for a passive income stream or a profitable way to diversify your investment portfolio, this investment opportunity can be a great addition. This article explains REITs for Beginners so that you can learn how to start investing and take advantage of these investment trusts.

#1. What are Real Estate Investment Trusts (REITs)?

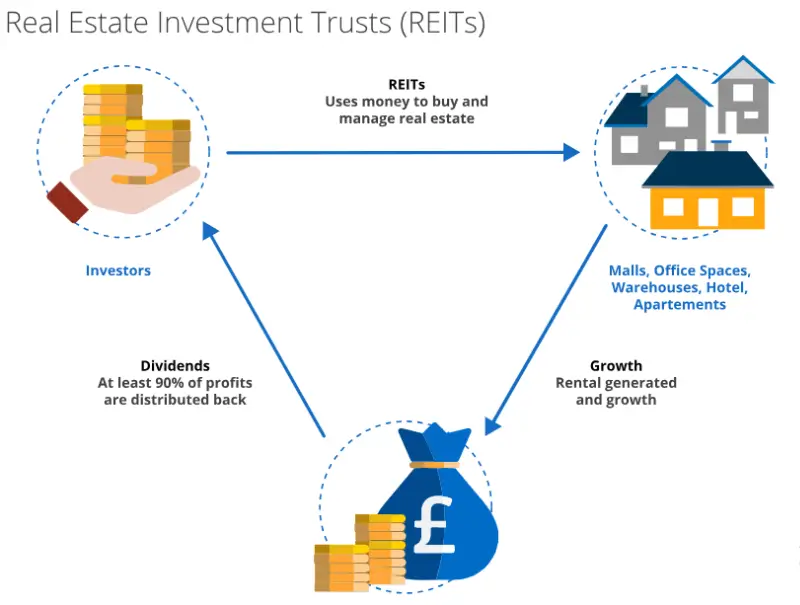

Real Estate Investment Trusts (REITs) are companies that own, operate, and finance real estate and offer investment opportunities to investors. These companies get funding from a pool of investors and use the funds to purchase and manage income-generating real estate properties. These properties are mostly rented out in exchange for rental income.

The properties may be apartment complexes, commercial buildings, or industrial spaces for company operations. The real estate trusts use investors’ funds to acquire and manage these properties. They also handle renovations, repairs, general upkeep, maintenance, and trustees’ fees for the properties.

The income generated from the rent is distributed as dividends to investors. The timeframe for the distribution of the dividends varies from one property fund to the other. Some distribute dividends to investors monthly, while others distribute them quarterly or annually. Top REITs are an attractive investment for individuals looking for income opportunities that place less demand on their time.

#2. How Much Can You Make Investing in REIT?

There are many potential benefits associated with Top REITs. For instance, these investments have a high potential for providing a predictable and stable stream of income. Also, the possibility for capital appreciation is high, making it an attractive investment option.

As the value of properties owned and managed by REITs appreciates, the share prices of the investment also increase. This offers capital gains to investors over time. According to the National Association of Real Estate Investment Trusts (Nareit), a platform that tracks the performance of all publicly traded real estate assets in the USA, the dividend yield for this investment type was 4.47% in August 2023.

This is three times the yield of the S&P 500. The platform also revealed that the average annual return, including dividends, during the five-year period, which ended in August 2023, was 3.58%. Meanwhile, the average per-year annual return for the ten years between 2013 and 2022 was 7.48%.

However, it is worth mentioning that, like many passive income ideas, many factors can affect the return on REITs. These include the market conditions, location and condition of properties within the investment portfolio, and the investment trusts’ management efficiency.

You will learn in this REIT guidebook that real estate investment trusts must return at least 90% of taxable income as shareholder dividends to investors each year.

#3. Types of Real Estate Investment Trusts (REIT)

There are different types of Real Estate Investment Trusts available in the market with each having its own characteristics and investment strategies. In this section, we’ll focus on the primary types.

· Equity REITs

Investments in this category function like landlords. They handle all management operations associated with owning a property. Equity REITs own properties, collect rent, handle maintenance, and reinvest in real estate assets.

These investments have a high potential for long-term growth and have no predetermined cap to potential returns. However, higher return potential also comes with higher risks.

· Mortgage REITs

Also known as mREITs, Mortgage REITs do not own real estate properties. They own the debt securities associated with the property. For instance, when an individual takes out a mortgage on a property, a Mortgage REIT may purchase the mortgage from the lender and receive the monthly payments over time.

With this arrangement, the individual owns and maintains the property while the company generates revenue through interest income. Top REITs are considered high-yield investments and are low-risk.

· Hybrid REITs

These combine equity and mortgage real estate investment trusts (REIT). They own and manage real estate properties and also own commercial property mortgages within their portfolio. These investments can support both income generation through mortgage investments and rental income, as well as long-term growth through equity investment appreciation.

Hybrid REIT focuses on available investments. However, there is another category that groups these investments based on how they are traded and how investors can access them. Understanding this category is critical for individual investors.

It lets you know if you can access such an investment and the minimum capital you need to invest. These real estate assets are publicly traded, non-traded, and private. Let’s look at these in detail.

· Publicly-traded REITs

These top REITs are regulated by the SEC, which has an added advantage for investors. They are also openly traded on a public exchange like ETFs and stocks and have the benefit of public reporting. With an ordinary brokerage account, you can invest in these Real Estate Investment Trusts.

According to the Nareit, there are over 200 publicly traded options currently on the market, including Vanguard REIT ETF. These investments offer investors a seamless way of accessing liquidity without a minimum holding period.

This means investors can readily buy and sell their real estate portfolios’ stocks without any delay. However, while there is no minimum holding duration, this daily liquidity access has an intrinsic cost called the “liquidity premium”. This reduces the earning potential of these investments.

· Public non-traded REITs

While Public non-traded REITs are registered with the SEC, they are unavailable on an exchange like their publicly-traded counterparts. Investors can only buy them from brokers who participate in public non-traded offerings. Since they are not publicly traded, they are highly non-liquid.

It’s important to mention that you can hold this investment portfolio for up to eight years or more before you can liquidate it. Additionally, they are difficult to value. According to the SEC, public non-traded REITs do not estimate their value to investors until about eighteen months after they close their offering.

This can be years after you have invested. There are many trading platforms online that allow investors to buy shares in these property funds, such as Fidelity and Schwab.

· Private REITs

Private REITs are unlisted, which makes them difficult to value and trade. Also, they are mostly exempted from SEC registration. Therefore, they have fewer disclosure requirements, which makes their performance difficult to measure. Like public non-traded, private REITs have high account minimums, which can be as high as $25,000 or more to start trading.

These investment opportunities are mostly open to only accredited investors classified as qualified to invest in complex securities types by the SEC. These investors boast a net worth of over $1 million or an annual income of a minimum of $200,000 in the past two years.

This figure excludes the value of their primary residence, and if they are married, the minimum combined income must be $300,000. According to Nareit, the REIT-indexed investments revealed a total annual return of 11.6%, which is higher than the annual return of Russell 1000 at 6.29%.

Overview of the Six Types of REITs

| Type | How It Works? | Pros | Cons | Ease of Use | Type of Investor |

|---|---|---|---|---|---|

| Equity REITs | Buys and manages real estate like apartments and malls | High dividends | Risky | Very Easy | Regular investors |

| Mortgage REITs | Invests in mortgages and loans for real estate | High dividends | Affected by changes in interest rates | Very Easy | Looking for regular income |

| Hybrid REITs | Owns properties and invests in mortgages | Balanced | Complex investment strategy | Very Easy | Looking for investment variety |

| Publicly Traded REITs | Buy properties and/or mortgages | Easy Buy/Sell | Unstable | Very Easy | Perfect for beginners |

| Public non-traded REITs | Buys properties and/or mortgages | Stable Value | Harder to sell | Medium | Long-term investors |

| Private REITs | Buys properties and/or mortgages | Higher returns | Higher risks | Hard | Qualified investors |

#4. How to Get Started with Real Estate Investment Trusts

Let’s mention that you can buy shares that are listed on any major stock exchange. Additionally, you can buy shares in these mutual funds or exchange-traded funds. So, how do you get started with these property investment trusts?

Step 1: Open a brokerage account. You can also use your workplace retirement plan if it offers REITs for beginners. However, if you are opening a fresh brokerage account, the process is pretty straightforward. You will provide your contact details and some personal details, such as a valid ID and Social Security number.

You may also be required to provide additional information on your occupation, investment experience, and income. Depending on your chosen broker, you can sign up in person at their branch location, on a mobile app, or on the broker’s website.

Step 2: Use the resources and research tools to review available REITs for beginners. Once you open an account and have access to it, get started with your research. Use the screening tool on your brokerage account to finetune your research and selection before making informed decisions on what to invest in.

Step 3: Choose an investment that suits your investment goals and financial needs, and proceed to purchase it only. We recommend that you understand the intricacies of the associated fees before investing. Read the fine print about the charges, fees, and expenses associated with the investment.

Step 4: Relax and earn from your investment. We recommend that you monitor your investment periodically as you would do with other investments.

#5. How Much Money Do You Need to Invest in Real Estate Investment Trusts?

This REITs guidebook can assure you that this investment is one of the easiest and cheapest passive income opportunities to explore. Depending on the type of option you invest in, you can add a real estate investment to your investment portfolio with as little as $1000, especially if you are investing in publicly traded property funds.

Of course, some options can have a minimum investment capital of up to $25,000. We recommend that you start small with a minimal amount.

#6. How Much Time Does It Require to Start and Maintain REIT Investment?

Compared to many investments, top REITs require little to no time from you after your initial investment. You do not need to invest any time all through the period of holding your investment. Simply research and select a broker, open an account, and start investing.

After this, you simply hold your investment and collect dividends without having to do anything. Of course, you may want to monitor the annual or quarterly performance of the investment to evaluate its alignment with your investment goals. With this, you can make informed decisions regarding holding, reinvesting dividends, or selling.

#7. Platforms to Access Real Estate Investment Trusts

Real estate portfolios undoubtedly offer stable passive income without the hefty acquisition costs and management headaches. However, with numerous platforms on the market, choosing the perfect broker can be a challenge.

In this section, we look at some of the popular options you can explore. We recommend you do your due diligence to understand everything about your preferred platform before investing.

Fidelity REITs

Fidelity offers a range of Real Estate Investment Trusts for new and experienced investors. It has individual portfolios, which allow investors to buy shares of publicly traded real estate securities on its platform. It also offers Fidelity Real Estate Index Fund (FSRNX), which provides diversified exposure to the US equity REITs.

The minimum investment depends on your chosen real estate trusts, especially for the individual REIT. For the FSRNX, the minimum is $1,000.

Pros of Fidelity:

- Has a strong reputation

- Lower fee

- Ample resources for first-time real estate trust investors

- Instant spread over different investment trusts’ sectors to mitigate risk

- Offers strategic portfolio building for individual real estate funds, catering to customized investment goals

Cons of Fidelity:

- Expense ratio and commissions eat deep into your profits

- Requires time and effort in research when choosing individual property funds

Charles Schwab REITs

Investors can explore the lucrative world of real estate portfolios on the Charles Schwab platform. It offers access to a wide range of individual real estate assets and customized investments under its Schwab US REIT ETF (SCHH). It boasts a low expense ratio of 0.07% on SCHH and no commission on US-listed individual real estate funds.

The minimum capital to enjoy commission-free trade on the Charles Schwab platform is $25,000. The minimum capital for SCHH is $100, while your chosen property investment trusts for individual REIT determine the minimum.

Pros of Charles Schwab:

- Excellent reputation as a trustworthy investment platform

- Extensive resources to equip investors to make informed decisions

- Commission-free trade for all US-listed REITs for both long-term investors and frequent traders

Pros of Charles Schwab:

- Entry barrier on commission-free trades with the $25,000 minimum balance

- Like Fidelity, choosing an individual REIT requires thorough research

M1 Finance REITs

A rising fintech company, M1 Finance, offers an innovative approach to investing in real estate portfolios with no commission for trading US-listed ETFs and stocks, including top REITs. M1 Pies lets you customize your investment portfolio based on your goals and risk tolerance. It also offers individual real estate assets, which allow users to fine-tune their portfolios to suit their needs.

Pros of M1 Finance:

- Basic accounts are free and premium accounts, M1 Plus, come with a monthly or annual subscription fee

- No minimum investment

- Provides great flexibility, enabling investors to create a portfolio tailored to their investment needs

- Highly cost-effective with no commission

Cons of M1 Finance:

- Limited research tools compared to more traditional platforms

- Absence of a long-standing track record of strong reputation

- Steep learning curve of the M1 Pies investment options

Fundrise REITs

Fundrise is a real estate crowdfunding platform offering a unique approach to property funds. With a focus on private real estate investments, it offers exposure to different assets, including apartments, industrial properties, and warehouses.

Its fee structure ranges from 0.85% to 1.05% annually based on the chosen portfolio. The minimum investment capital is $10, allowing all investors to invest.

Pros of Fundrise:

- Easy access to private real estate markets ordinarily reserved for institutions

- Offers pre-built investment portfolios and customization tools

- Minimum capital requirement, making it a good choice for budget-conscious investors

Cons of Fundrise:

- Requires you to lock your investment for an extended period of 5-10 years

- Performance and investment fees can significantly reduce your returns

- Limited control over management decisions and property selection

Comparison of REIT Investment Platforms

| Platform | Features | Benefits | Drawbacks | Fee | Who Is It For? |

|---|---|---|---|---|---|

| Fidelity | Comprehensive research tools | Extensive resources & strong customer support | Complex for beginners | Nil | Investors looking for a variety |

| Charles Schwab | Large selection, research tools | Easy to use | None | Nil | Investors looking for a variety |

| M1 Finance | Customizable portfolios | User-friendly | Limited customer service | Nil | Tech-savvy investors |

| Fundrise | Access to private real estate deals | Perfect for beginners | Lower liquidity | 0.85- 0.15% | Investors looking for direct exposure |

#8. How to Choose the Best Real Estate Investment Trusts Platform

When it comes to investing in Real Estate Investment Trusts, this REITs guidebook emphasizes the need to choose the right platform for your success. Here are some tips to help you choose the best platform that aligns with your investment needs:

Fees and Costs: What will it cost you to use the platform? Pay close attention to the fees associated with trading on the platform. Some brokers charge trading fees, account maintenance fees, and other hidden costs. Take the time to understand these costs and compare the fees of different platforms to make sure you are not overpaying.

Investment Options: Your chosen platform should ideally offer a wide range of property investment trusts for you to choose from. Some platforms specialize in specific top REITs. Therefore, do your research to find the perfect one that matches your investment goals and interests.

Ease of Use: When choosing a platform, ensure you select one that offers user-friendly navigation and doesn’t require you to be a tech expert to use it. The first place to check this is through the sign-up process. If the process is windy, you may want to reconsider your choice. Additionally, check the layout to see if it’s clear and intuitive enough for your liking.

Research and Resources:

A good platform should provide you with enough information and tools to make informed investment decisions. Look for platforms that offer market analysis, research reports, and educational resources about real estate investment and REIT.

Security: Your financial details and investment need to be secure. Therefore, find a platform that uses strong encryption and has other security measures in place to protect your data. Also, make sure that the platform is regulated by relevant financial authorities.

Reputation and Reviews: You can avoid headaches down the line by taking the time to read reviews before choosing an investment platform. Do some research on the reputation of the platform, and read users’ reviews to see if they have had positive experiences while using the services. Additionally, read a REITs guidebook and check to see if the platform is well-regarded within the investment community.

Minimum Investment Requirements: These vary between platforms. Some platforms have higher requirements, which might not be suitable for everyone. Therefore, research and look for platforms that offer flexibility with lower minimums, especially if you want to start with a smaller amount of money.

By considering these tips, you can find a REIT platform that suits your investment needs and helps you attain your investment goals.

#9. What to Consider Before Investing in Real Estate Investment Trusts

Top REITs are a great way to invest in the real estate market without the challenge of direct ownership. However, before you invest in these, you must consider different factors to enable you to make informed decisions. Here are the top things to consider before investing in Real Estate Investment Trusts:

Investment Goals

Why do you want to invest in REITs? You must think about why you want to invest in these opportunities before going into it. Are you looking for regular income through dividends, diversification of your investment portfolio, or long-term growth? Understanding your goals can help you choose the right type of real estate portfolio.

Risk Tolerance

Like all investments, REITs also come with risks. The value of Real Estate Investment Trusts can go up and down based on the economic conditions and the real estate market. Make sure you are comfortable with the level of risk involved before investing.

Dividend Yields

Top REITs are known for paying high dividends. However, not all real estate funds have the same yield. We recommend that you look at the dividend history and the current yield of the property funds you are considering to see if they suit your investment goals and income needs.

Tax Implications

Dividends on a REIT are taxed as ordinary income. Therefore, we recommend that you consult with your tax advisor to know the tax implications of investing in Real Estate Investment Trusts.

#10. Key Performance Metrics for Evaluating REITs

When deciding which REIT to invest in, it pays to look beyond headline numbers like share price and dividend yield.

Three crucial metrics are:

Funds from Operations (FFO):

This measures the REIT’s net income from operational activities—excluding any gains or losses from property sales. It’s a better indicator of cash flow than standard earnings per share (EPS).

Adjusted Funds from Operations (AFFO):

AFFO refines FFO by subtracting ongoing capital expenses related to property upkeep and improvements. It helps you assess the true amount of cash available for dividends.

Net Asset Value (NAV):

NAV evaluates the overall value of the real estate holdings minus liabilities. If the REIT’s share price is significantly below its NAV, it may be undervalued, or vice versa

#11. Diversification Within Your REIT Portfolio

Different Property Types:

Residential, commercial, industrial, or healthcare properties can respond differently to market cycles. Having exposure to multiple types spreads your risk.

Geographic Spread:

Region-specific factors like local employment trends, supply-and-demand dynamics, and population growth rates can significantly impact property values.

Mixing Public, Private, and Non-Traded REITs:

A balanced approach can combine the liquidity of publicly traded REITs with the potentially higher return (but less liquid) nature of private or non-traded options.

By diversifying, you reduce the impact one underperforming sector or property could have on your entire investment portfolio.

#12. Real Estate Cycles and Market Timing

Expansion: Demand for real estate increases, prompting development and rising prices.

Peak: Market sentiment is high, and property prices may be inflated.

Contraction: Market slows due to oversupply or reduced demand, leading to price declines.

Trough: The market bottoms out, sometimes presenting excellent buying opportunities.

While no one can perfectly time the market, staying informed about these cycles—through economic indicators, local market reports, and interest-rate policies—helps you decide when to add to or reduce your REIT positions.

#13. Interest Rates and Their Impact on REIT Performance

Borrowing Costs: REITs often leverage debt to buy properties. A rise in interest rates can escalate their financing costs, reducing profit margins.

Investor Preference: Higher interest rates can make bonds more attractive relative to REITs, sometimes causing REIT share prices to decline.

Rental Market Dynamics: When mortgage rates increase, fewer people can afford to buy homes, often driving up rental demand in residential REITs.

Monitoring economic news and understanding how changes in rates can alter your REIT’s profitability is key to maintaining a strong portfolio.

#14. Management Quality and Corporate Governance

Track Record: Check the REIT’s history of dividend payouts, property acquisitions, and occupancy rates under its current management.

Transparency: Look for a commitment to open and detailed reporting. This includes how they present operating costs, property valuations, and future growth plans.

Alignment with Investors: When top executives have a personal stake in the company, they’re often more motivated to drive consistent growth and income.

#15. Occupancy Rates and Tenant Mix

Occupancy Rate: A higher occupancy generally indicates stable rental income. Repeated low occupancy may be a red flag for location or management issues.

Tenant Quality: Commercial REITs with solid corporate tenants are likely to enjoy stable rent payments over long lease terms, while residential REITs may need to evaluate turnover rates and local job markets.

Sector Considerations: A shopping mall REIT might have big-name anchor stores, but if brick-and-mortar retail is struggling in that region, occupancy may drop, impacting profitability

These factors affect long-term dividend stability and growth potential.

#16. Dividend Reinvestment Plans (DRIPs)

Many REITs offer Dividend Reinvestment Plans (DRIPs), allowing you to:

Automate Reinvestment: Instead of receiving cash dividends, you automatically purchase more shares, often at little to no extra cost.

Compound Growth: Reinvested dividends can accelerate portfolio growth over time through compounding.

Dollar-Cost Averaging: By acquiring shares regularly, you average out the share price, potentially reducing the impact of market volatility.

#17. Global REIT Opportunities

Currency Diversification: If the foreign currency strengthens against your home currency, you may see a boost in returns.

Different Growth Patterns: Some emerging markets might yield higher growth rates, although they can come with higher risk.

Regulatory Differences: REIT regulations vary by country, influencing liquidity, transparency, and minimum investment requirements.

Global diversification spreads your risk across multiple regions and could help you tap into real estate booms abroad.

#18. Tax-Advantaged Accounts for Holding REITs

Individual Retirement Accounts (IRAs): Traditional IRAs can defer taxes, while Roth IRAs allow tax-free growth (if you meet withdrawal requirements).

401(k) Plans: Some workplace retirement plans feature REITs within their investment options, offering a straightforward way to gain exposure.

Health Savings Accounts (HSAs): Though primarily for medical expenses, HSAs can serve as long-term investment vehicles if used strategically.

Consult a tax professional to determine the optimal account type based on your specific financial situation.

#19. The Importance of Ongoing Research and Rebalancing

Stay Informed: Economic shifts, regulatory changes, and market news can affect REIT performance.

Monitor Your Holdings: Evaluate periodically whether your REIT still meets your investment goals or if performance has deteriorated.

Rebalance Consistently: If REITs become a larger percentage of your portfolio than intended, selling some shares or adding to other asset classes helps maintain your desired risk profile.

This proactive approach will ensure your REIT investments continue aligning with your financial objectives over the long haul.

Conclusion

This REIT guidebook explains how Real Estate Investment Trusts can be a great investment option and a comfortable way of getting into the real estate market without the stress of owning and managing the properties yourself. This post has explored what REITs are, the different types available, what to consider before investing, and the popular platforms available for your investment.

Using these insights, you can make choices that match your investment priorities and financial objectives.

Whether you’re looking for regular passive income from dividends or a way to diversify your investment portfolio, REITs offer several benefits. However, before investing, do your research, assess your risk tolerance, and select a platform that suits your needs.

Apart from REITs, there are many other interesting opportunities to earn passive income. Check out the 26 Passive Income Ideas to Build Wealth 2026 to get a complete lowdown on them.

Is there something even better than REITs?

For any investor the most important factors to consider before investing are ROI and risk level. The average per year annual return for REITs for the ten years between 2013 and 2022 was 7.48%. On the other hand, CafeXbot robotic cafe gives an annual ROI of 80% – 120% plus when placed in strategic locations like amusement parks, busy waterfronts and business centers. It comes with a very low risk level and has been running profitably in 10 countries. Check out why CafeXbot is a great addition to your investment portfolio.